HS Code

HS Code: The Universal Language of Trade

The Harmonized System (HS) Code is an internationally standardized system for classifying traded products. Developed by the World Customs Organization (WCO), this 6-digit code is used by customs authorities worldwide to identify goods and apply tariffs.

How HS Codes Work

Every product crossing international borders requires an HS code classification. The code structure follows a logical pattern:

- First 2 digits: Identify the product chapter (e.g., 09 for coffee)

- Next 2 digits: Specify the heading (e.g., 01 for roasted coffee)

- Final 2 digits: Define subheadings for precise classification

Why HS Codes Matter

Accurate HS code classification is essential for:

- Calculating correct import/export duties

- Complying with trade regulations

- Generating accurate commercial invoices

- Maintaining smooth customs clearance

- Tracking international trade statistics

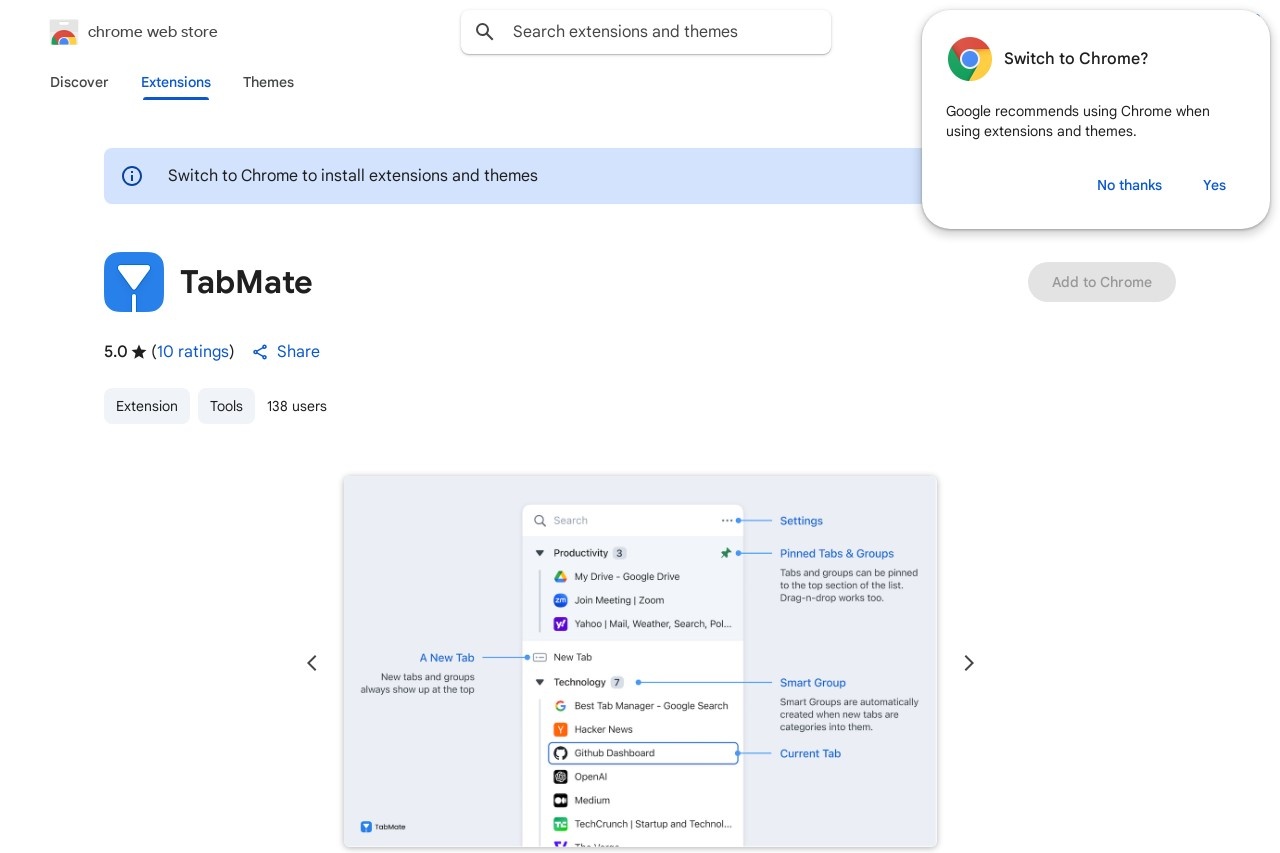

Using HS Code Classification Tools

Modern classification tools help businesses:

- Search products by keywords or descriptions

- Navigate the HS code hierarchy

- Access updated tariff information

- Verify classification rules

- Generate supporting documentation

While most countries use the 6-digit HS code as a base, many nations add extra digits for domestic purposes. For example, the U.S. uses 10-digit HTS codes, while the EU employs 8-digit CN codes.

Proper HS code classification requires understanding both the product characteristics and the Harmonized System's General Rules of Interpretation. When in doubt, consult customs experts or use official government resources.